HALDIMAND—From soaring housing costs to shrinking lot sizes, Haldimand County’s latest Housing Needs Assessment delivers a sharp diagnosis and a call to action.

Presented at the May 20, 2025 Council-in-Committee meeting, the assessment outlines current challenges, future forecasts, and strategic directions to guide housing policy through to 2051.

The report, prepared by Watson & Associates Economists Ltd., was introduced by Senior Land Economist Erik Karvinen and received unanimous support from Council.

Developed to meet federal requirements under the Canada Community-Building Fund, the assessment is also expected to serve as a foundation for a forthcoming affordable housing strategy and future updates to the County’s Official Plan.

Karvinen began by outlining the context of the report.

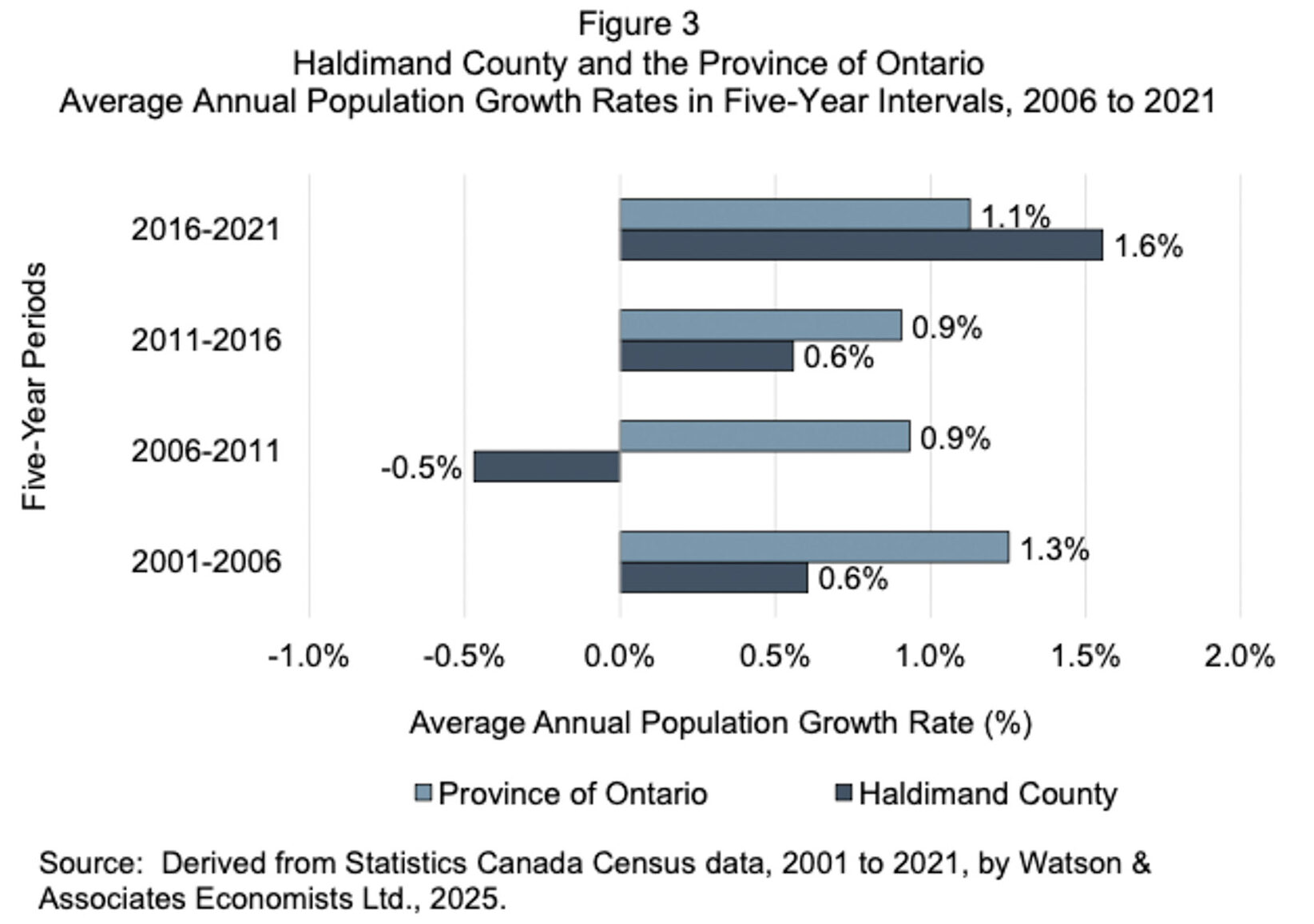

Haldimand County, like many Ontario municipalities, has seen accelerated population growth, rising to an estimated 57,000 in 2024 from about 47,000 in 2016.

Housing development has not kept pace with the growing population and shifting demographics, and affordability has significantly eroded.

Over the past decade, the County has averaged 310 new residential units per year, with the rate increasing in recent years.

Despite that growth, the housing supply remains heavily weighted toward low-density, ownership units: 88% of existing dwellings are single- or semi-detached homes, and 85% are owner-occupied. Only 15% of households are renters – far below the provincial average of 31%.

Council’s attention quickly turned to the implications of the provided figures.

Ward 4 Councillor Brad Adams asked whether the infrastructure exists to support the 11,000 new homes the report says are needed by 2051.

“Infrastructure capacity is a key issue,” said Karvinen. “Servicing limitations, especially in urban settlement areas, could hinder the ability to deliver on these housing targets.”

Adams followed up by asking how the County could prepare to meet the projected demand of 4,575 new homes over the next decade, particularly as many of the current development proposals are targeted at the upper end of the market.

Karvinen confirmed that the bulk of housing currently in the pipeline does not meet affordability thresholds. He noted that 1,450 of the forecast units by 2035 must be affordable – including 1,045 ownership units and 405 rental units – to meet the needs of lower- and moderate-income households.

Ward 5 Councillor Rob Shirton raised questions about population trends.

“How much of our growth is internal, and how much is driven by immigration?” he asked.

Karvinen responded that net migration, both from other parts of Ontario and internationally, would be the dominant driver of growth in the decades ahead. This trend, he said, requires careful consideration of housing diversity to accommodate newcomers.

Shirton also queried the type and location of future development, especially in light of limited rental stock and supportive housing.

Karvinen pointed to urban settlement areas – such as Caledonia, Cayuga, and Dunnville – as logical sites for infill and intensification due to their access to services.

The assessment reveals that rental affordability is especially constrained. As of 2024, average apartment rents had increased 84% over the past five years, rising to $1,485 from just $805 in 2020.

Ownership affordability has also worsened: the average resale home price jumped 49% over the same period, now sitting at $667,000. These price increases have significantly outpaced both wage growth and inflation.

The assessment defines affordable ownership housing as costing no more than $391,600. New construction prices, however, are well above that: the average price for single detached homes is $922,000 and for townhouses it is $665,000.

Ward 3 Councillor Dan Lawrence asked whether the County was counting on conceptual land or shovel-ready sites to meet future needs.

“Most of the development projects underway are for the ownership market, and nearly all fall above the affordability threshold,” Karvinen said. “We have a land supply, but it’s not necessarily an affordable one.”

Mike Evers, General Manager of Community & Development Services, added that affordability is a major concern for staff.

“The data reinforces what we’ve been hearing anecdotally for years,” said Evers. “We need a more diverse housing stock and better tools to ensure affordability.”

The report outlines several strategic directions, including incentives for affordable housing development, zoning updates to encourage density, and expanded support for non-market housing.

Additional residential units (ARUs), such as basement apartments and garden suites, were highlighted as key to increasing the affordable rental supply through gentle intensification.

Mayor Shelley Ann Bentley stressed the importance of aligning the County’s policies with updated provincial frameworks. “This isn’t just about bricks and mortar. It’s about creating communities where everyone has the opportunity to live with dignity and security,” she said.

Ward 1 Councillor Debera McKeen asked how seniors were being considered in the County’s planning efforts.

Karvinen noted that the 65+ demographic had grown significantly and will continue to increase, driving demand for accessible, low-maintenance housing types near services.

“There’s an opportunity to support aging in place through the development of mid-density options, especially in walkable areas,” he said.

The Housing Needs Assessment also confirms a structural deficit in non-market housing. Only 2% of the County’s current housing stock qualifies as publicly funded or non-profit, compared to 98% in the private market.

Approximately 550 households in Haldimand are on the waiting list for non-market units, and 395 are living in severe core housing need, spending over 50% of income on housing that may also be overcrowded or in poor condition.

The County’s vacancy rate is just 0.6%, far below the healthy market benchmark of 3%. This places pressure on all segments of the market, particularly for those seeking rental accommodation.

Council ultimately approved the report and the accompanying federal Housing Needs Assessment Template, which is required to maintain access to federal infrastructure funding through the Canada Community-Building Fund.

Haldimand receives approximately $3.3 million annually through this program.

Evers described the approval as a milestone.

“This gives us a concrete data foundation for developing a comprehensive housing strategy, one that can be linked with future planning, budgeting, and infrastructure investments,” he said.

The Housing Needs Assessment will be updated every five years, with the next step expected to be a formal housing affordability strategy.

Staff also indicated that future budget and policy discussions will likely include incentives, community improvement plans, and regulatory changes aimed at improving housing accessibility and diversity.